February Market Update

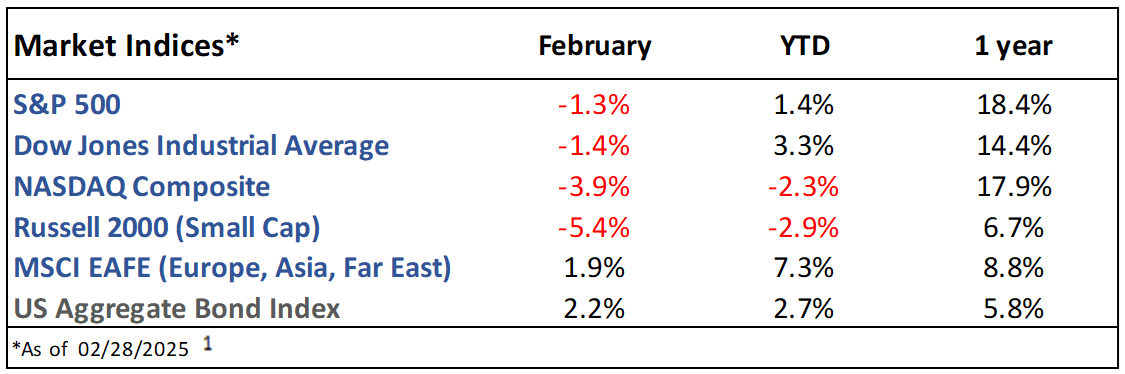

Market Indices Performance

February Recap

The S&P 500 fell 1.3% in February; International stocks outperformed again and have been the clear leader in 2025 so far after years of underperformance.(1) The yield on the 10yr Treasury continued to slide in February as investors curbed future growth expectations. Inflation, measured by the Consumer Price Index (CPI), rose 2.8% from last year, marking the 48th straight month above the Federal Reserve’s 2% target. However, the 0.2% month-over-month number was a welcome decrease from previous months (figure 1).(2) The economy added 150k jobs in February and the unemployment rate ticked slightly higher to 4.1%, marking its 10th straight month in the 4.0%-4.3% range.(3) Job openings creeped higher to 7.7m, and the ratio of jobs available to unemployed people remains healthily above 1.(4) All this points to a continually strong labor market, even with recession talks reigniting as investors fear a potential trade war.

The Present

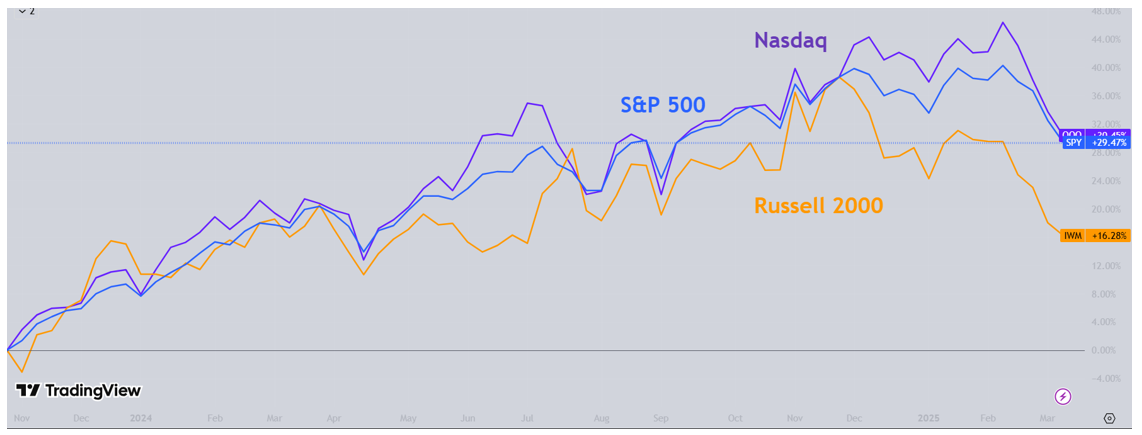

Q4 2024 earnings season ended with 18% growth, higher than the 12% expected.(5) Despite this, the S&P 500 entered correction territory (a 10% drop from all-time highs), following the Nasdaq and small/mid caps after several highly volatile trading sessions. While tariff uncertainty, stretched valuations, and declining growth expectations (Q1 2025 GDP is now forecasted to be negative) merit a drop, we also see this as a healthy, even necessary, pullback after impressive gains since the last correction in October 2023 (figure 2).(6) Despite this market volatility, Treasury yields have remained relatively stable in March.(7) Mortgage rates have bounced between 6%-8% since the beginning of 2023, and now sit around 6.5%.(8)

The Future

Analysts predict earnings growth of 7% for Q1 2025 and 12% for all of 2025, with growth finally widening out from the Big Tech names.(5) Wall Street is now expecting 3 interest rate cuts this year, while the Federal Reserve’s latest prediction was 2; Chairman Jerome Powell said they are in no hurry to cut.(9,10) March is historically an average month for the stock market.(11) Trump’s tariffs have begun, notably with a 25% tariff on all goods from Canada and Mexico. Several product-specific tariffs as well as reciprocal tariffs are set to begin on April 2nd, barring another delay.(12) The market has not liked this uncertainty, but the Trump administration sees this short-term pain as a worthy price to pay for long-term gain.

1. https://ycharts.com/indices/%5ESPXTR, https://ycharts.com/indices/%5EDJITR, https://ycharts.com/indices/%5ENACTR, https://ycharts.com/indices/%5ERUTTR, https://ycharts.com/indices/%5EMSEAFETR, https://ycharts.com/indices/%5EBBUSATR – Index Performance

2. https://www.bls.gov/news.release/pdf/cpi.pdf - CPI

3. https://www.investing.com/economic-calendar/nonfarm-payrolls-227 - Jobs reports

4. https://fred.stlouisfed.org/graph/?g=12kNG - Job openings

5. https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_031425.pdf - Earnings expectations

6. https://www.atlantafed.org/cqer/research/gdpnow - GDP estimates

7. https://www.cnbc.com/bonds/ - Treasury yields

8. https://fred.stlouisfed.org/series/MORTGAGE30US - Mortgage Rates

9. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html – Investor rate expectations

10. https://www2.deloitte.com/us/en/insights/economy/spotlight/fed-rate-cuts-and-us-labor-market-trends.html - Fed Outlook

11. https://www.nasdaq.com/articles/heres-the-average-stock-market-return-in-every-month-of-the-year – Monthly market history

12. https://www.tradecomplianceresourcehub.com/2025/03/13/trump-2-0-tariff-tracker/ - Trump tariffs

The Gasaway Team

7110 Stadium Drive

Kalamazoo, MI 49009

(269) 324-0080

FAX (269) 324-3834

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. This presentation is not an offer or a solicitation to buy or sell securities. The material discussed is meant to provide general education information only and it is not to be construed as specific investment, tax or legal advice and does not give investment recommendations.

Certain risks exist with any type of investment and should be considered carefully before making any investment decisions. Keep in mind that current and historical facts may not be indicative of future results.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, https://adviserinfo.sec.gov/firm/summary/123807.